Valuation models for private properties

Available valuation methods

In addition to hedonic models, numerous other evaluation methods are available.

- Hedonic valuation (analysis of the current state)

- Hedonic valuation (new construction - age value reduction)

- Real value method (simplified)

- Real value method according to §§ 21 - 23 ImmoWertV

- Earning capacity method (simplified)

- Earning capacity method according to §§ 17 - 20 ImmoWertV

Hedonic models

The core of the valuation models are hedonic models for condominiums and single-family houses. These statistical sales comparison models are based on well-documented transaction data.

Market-based model suggestions

Various sub-models provide you with current and market-oriented suggestions concerning model inputs and

valuation assumptions.

- Classification condition

- Classification standard

- Derivation of micro-location

- Parking (market value parking space)

- Sustainable rent

- And many more...

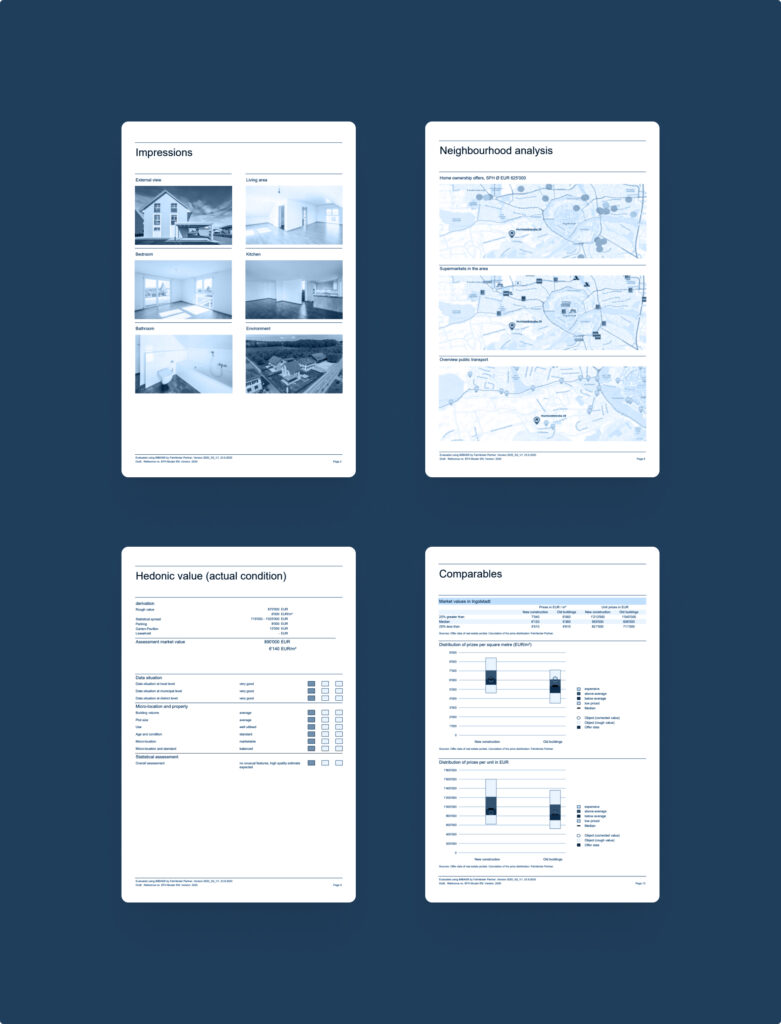

Valuation reports

Generate comprehensive reports of your valuations. All at the touch of a button and enriched with comprehensive market data. All reports can be tailored to your CI specifications.

Valuation models for

Appraisers

Create detailed and professional valuation reports. IMBAS supports you with up-to-date and evidence-based model suggestions.

Brokers

Use hedonic models to efficiently determine market values. Impress your customers with comprehensive analyses and reports.

Banks

IMBAS supports you in your mortgage business and risk management with independent and transaction-based valuation models.

Developers

Use the valuation models for residential property to determine and check the plausibility of condominium prices.

Schweiz

Schweiz